UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __)

x Filed by the Registrant

¨ Filed by a Party other than the Registrant

Check the appropriate box:

| Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

| FIRST KEYSTONE CORPORATION |

| (Exact name of registrant as specified in its Charter) |

| (Name of Person(s) Filing Proxy Statement if other than Registrant) |

Payment of Filing Fee (check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applied: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| First Keystone Corporation |

| 111 West Front Street |

| Berwick, Pennsylvania 18603 |

March 23, 201228, 2013

Dear Fellow Shareholders of First Keystone Corporation:

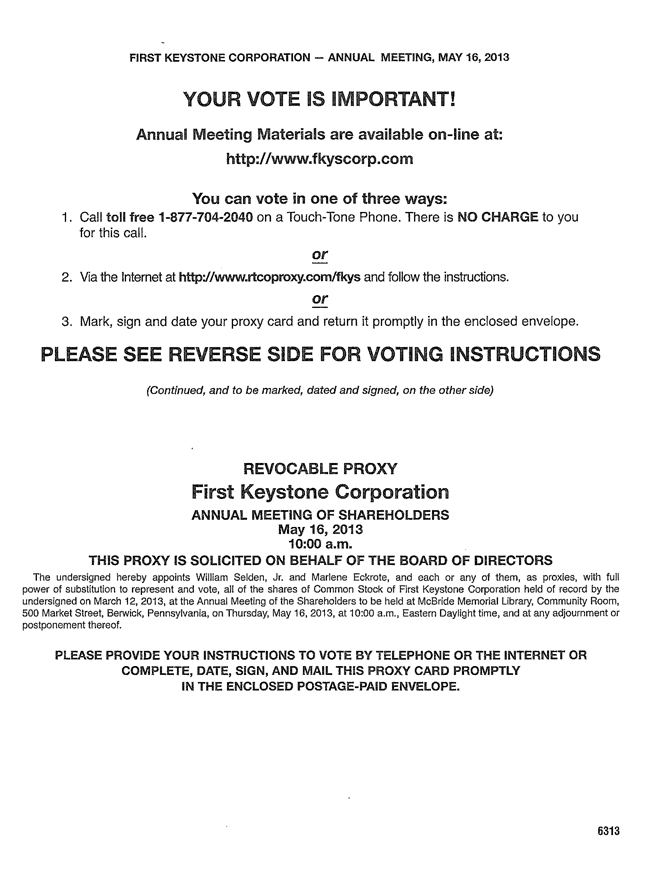

It is my pleasure to invite you to attend the 20122013 Annual Meeting of Shareholders of First Keystone Corporation (the “Corporation”) to be held on Thursday, May 10, 2012,16, 2013, at 10:00 a.m., Eastern Daylight Time. The Annual Meeting this year will be held at the McBride Memorial Library, Community Room, 500 Market Street, Berwick, Pennsylvania 18603.

The Notice of the Annual Meeting and the Proxy Statement on the following pages address the formal business of the meeting. The formal business schedule includes:

At the meeting, members of the Corporation’s management will review the Corporation’s operations during the past year and will be available to respond to questions.

We strongly encourage you to vote your shares, whether or not you plan to attend the meeting. It is very important that you sign, date and return your Proxy Statementproxy card as soon as possible. The execution and delivery of your proxy does not affect your right to vote in person if you attend the meeting. You may revoke your proxy any time prior to its exercise, and you may attend the meeting and vote in person, even if you have previously returned your proxy.

Thank you for your continued support. I look forward to seeing you at the Annual Meeting if you are able to attend.

| Sincerely, | |

| |

| Matthew P. Prosseda | |

| President and Chief Executive Officer |

[THIS PAGE INTENTIONALLY LEFT BLANK]

[ THIS PAGE INTENTIONALLY LEFT BLANK ]FIRST KEYSTONE CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 10, 201216, 2013

TO THE SHAREHOLDERS OF FIRST KEYSTONE CORPORATION:

Notice is hereby given that the Annual Meeting of Shareholders (the “Annual Meeting”) of First Keystone Corporation (the “Corporation”) will be held at 10:00 a.m., Eastern Daylight Time, on Thursday, May 10, 2012,16, 2013, at the McBride Memorial Library, Community Room, 500 Market Street, Berwick, Pennsylvania 18603, for the following purposes:

1. To elect 34 Class AB Directors to serve for a three-year term and until their successors are properly elected and qualified;

2. To ratify the selection of J. H. Williams & Co., LLP as the independent registered public accounting firm (“Independent Accountants”) for the Corporation for the fiscal year ending December 31, 2012;2013; and

3. To approve and adopt an amendment to Article 5 of the Corporation’s Articles of Incorporation to increase the amount of authorized shares of the Corporation’s common stock, par value $2.00 per share, from 10,000,000 to 20,000,000;

4. To approve and adopt an amendment to Article 5 of the Corporation’s Articles of Incorporation to authorize 1,000,000 shares of preferred stock;

5. To approve and adopt an amendment to Article 7 of the Corporation’s Articles of Incorporation to provide for a two-tiered supermajority clause regarding fundamental transactions; and

6. To transact any other business as may properly come before the Annual Meeting and any adjournment or postponement of the meeting.

In accordance with the bylaws of the Corporation and action of the Board of Directors, the Corporation is giving notice of the Annual Meeting only to those shareholders on the Corporation’s records as of the close of business on March 6, 2012,12, 2013, and only those shareholders may vote at the Annual Meeting and any adjournment or postponement of the Annual Meeting.

A copy of the Corporation’s Annual Report on Form 10-K for the fiscal year ended December 31, 20112012 may be obtained, at no cost, by contacting Cheryl Wynings, Investor Relations, First Keystone Corporation, 111 West Front Street, Berwick, PA 18603, telephone: (570) 752-3671, extension 1175.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to be Held on May 10, 2012:16, 2013:

The 20122013 Proxy Statement, the proxy card, the Notice of Annual Meeting of Shareholders and

the 20112012 Annual Report on Form 10-K are also available at: www.fkyscorp.com.www.fkyscorp.com.

Whether or not you expect to attend the Annual Meeting in person, we ask you to complete, sign, date and promptly return your proxy card. By so doing, you will ensure your proper representation at the meeting. The prompt return of your signed Proxy Statementproxy card will also save the Corporation the expense of additional proxy solicitation. The execution and delivery of your Proxy Statementproxy card does not affect your right to vote in person if you attend the meeting.

| By Order of the Board of Directors, | |

| |

| Matthew P. Prosseda | |

Berwick, Pennsylvania

March 28, 2013

Berwick, Pennsylvania

March 23, 2012

PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS

OF FIRST KEYSTONE CORPORATION TO BE HELD ON MAY 10, 201216, 2013

Table of Contents

| Page | ||

| General Information | 3 | |

| Introduction, Date, Time and Place of Annual Meeting | 3 | |

| Solicitation and Voting of Proxies | 3 | |

| Revocability of Proxy | 4 | |

| Voting Securities, Record Date and Quorum | 4 | |

| Vote Required for Approval of Proposals | 4 | |

| Advisory Vote on Executive Compensation | ||

| Governance of the Company | 5 | |

| Code of Ethics | 6 | |

| Committees of the Board of Directors | 6 | |

| Committees of the Bank | ||

| Shareholder or Interested Party Communications | ||

| Shareholder Proposals and Nominations | ||

| Proposal No. 1: Election of Class | ||

| Information as to Directors and Nominees | ||

| Share Ownership | ||

| Principal Owners | ||

| Beneficial Ownership by Officers, Directors and Nominees | 13 | |

| Directors’ Compensation Table | ||

| Compensation of Directors | ||

| Report of the Audit Committee | 16 | |

| Compensation Discussion and Analysis | ||

| Executive Compensation | ||

| Principal Officers of the Bank and the Corporation | ||

| Legal Proceedings | ||

| Proposal No. 2: Ratification of Independent Registered Public | ||

| Section 16(a) Beneficial Ownership Reporting Compliance | ||

| Incorporation by Reference | ||

| Other Matters |

| Page 2 |

PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS

OF FIRST KEYSTONE CORPORATION TO BE HELD ON MAY 10, 201216, 2013

GENERAL INFORMATION

Introduction, Date, Time and Place of Annual Meeting

First Keystone Corporation (the “Corporation”), a Pennsylvania business corporation and registered bank holding company, furnishes this Proxy Statement in connection with the solicitation, by its Board of Directors, of proxies to be voted at the Annual Meeting of Shareholders (the “Annual Meeting”) and at any adjournment or postponement of the Annual Meeting. The Corporation will hold the meeting on Thursday, May 10, 2012,16, 2013, at 10:00 a.m., Eastern Daylight Time, at the McBride Memorial Library, Community Room, 500 Market Street, Berwick, Pennsylvania 18603.

When we say “we”, “us”, “our” or the “Company”, we mean the Corporation on a consolidated basis with the Bank.

The principal executive office of the Corporation is located at First Keystone Community Bank (the “Bank”), 111 West Front Street, Berwick, P.O. Box 289, Pennsylvania 18603. The Bank is the sole, wholly-owned subsidiary of the Corporation. The telephone number for the Corporation and the Bank is (570) 752-3671. All inquiries should be directed to Matthew P. Prosseda, President and Chief Executive Officer of the Corporation and the Bank.

Solicitation and Voting of Proxies

By properly completing and returning your Proxy Statement,proxy card, a shareholder is appointing the proxy holders to vote his or her shares as the shareholder specifies on the proxy. If a shareholder signs the proxy but does not make any selection, the proxy holders will vote the proxy:

Although the Board of Directors (the “Board”) knows of no other business to be presented at the Annual Meeting, in the event that any other matters are properly brought before the meeting, any proxy given pursuant to this solicitation will be voted in accordance with the recommendations of the Board.

The execution and return of your proxy card will not affect your right to attend the Annual Meeting and vote in person.

The Corporation will pay the cost of preparing, assembling, printing, mailing and soliciting proxies and any additional material that the Corporation may furnish shareholders in connection with the Annual Meeting. In addition to the use of the mail, directors, officers and employees of the Corporation and the Bank may solicit proxies personally, by telephone, or other electronic means. The Corporation will not pay any additional compensation for the solicitation. The Corporation will make arrangements with brokerage houses and other custodians, nominees and fiduciaries to forward proxy solicitation material to the beneficial owners and will reimburse them for their reasonable forwarding expenses.

| Page 3 |

Revocability of Proxy

A shareholder who returns a proxy may revoke the proxy at any time before it is voted only:

Voting Securities, Record Date and Quorum

At the close of business on March 6, 2012,12, 2013, the Corporation had 5,446,0375,480,217 shares of common stock outstanding, par value $2.00 per share. Our common stock is the Corporation’s only issued and outstanding class of stock. The Corporation also had 241,730237,183 shares held in treasury, as issued but not outstanding shares on that date. The Corporation’s Articles of Incorporation authorize the issuance of up to 10,000,00020,000,000 shares of common stock and 1,000,000 shares of preferred stock. No shares of preferred stock are issued or outstanding.

Only shareholders of record as of the close of business on March 6, 2012,12, 2013, may vote at the Annual Meeting. Cumulative voting rights do not exist with respect to the election of directors. On all matters to come before the Annual Meeting, each shareholder is entitled to one vote for each share of common stock held on the record date.

Pennsylvania law and the bylaws of the Corporation require the presence of a quorum for each matter that shareholders will vote on at the Annual Meeting. The presence, in person or by proxy, of shareholders entitled to cast at least a majority of the votes that all shareholders are entitled to cast constitutes a quorum for the transaction of business at the Annual Meeting. The Corporation will count votes withheld and abstentions in determining the presence of a quorum for a particular matter. The Corporation will not count broker non-votes in determining the presence of a quorum for a particular matter. A broker non-vote occurs when a broker nominee, holding shares for a beneficial owner, does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item, and has not received instructions from the beneficial owner. Those shareholders present, in person or by proxy, may adjourn the meeting to another time and place if a quorum is lacking.

Vote Required for Approval of Proposals

Assuming the presence of a quorum, the 34 nominees for director receiving the highest number of votes cast by shareholders will be elected. Votes withheld from a nominee and broker non-votes will not be cast for the nominee.

Assuming the presence of a quorum, ratification of the selection of Independent Accountants requires the affirmative vote of a majority of all votes cast by shareholders, in person or by proxy, on the matter.

Assuming the presence of a quorum, the proposed amendment to Article 5 of the Corporation’s Articles of Incorporation increasing the authorized shares of the Corporation’s common stock from 10,000,000 to 20,000,000 will be approved and adopted if a majority of the votes cast at the Annual Meeting voteFOR the proposal.

Assuming the presence of a quorum, the proposed amendment to Article 5 of the Corporation’s Articles of Incorporation authorizing 1,000,000 shares of preferred stock will be approved and adopted if a majority of the votes cast at the Annual Meeting voteFOR the proposal.

Assuming the presence of a quorum, the proposed amendment to Article 7 of the Corporation’s Articles of Incorporation providing for a two-tiered supermajority clause regarding fundamental transactions will be approved and adopted if a sixty-six and two-thirds percent (66 2/3%) of the issued and outstanding shares of the Corporation’s common stock entitled to vote at the Annual Meeting voteFOR the proposal.

Abstentions and broker non-votes are not votes cast and do not count eitherFOR for orAGAINST Proposals No. 2, 3, 4 or 5. Regarding Proposals No. 2, 3 and 4, abstentions against ratification. Abstentions and broker non-votes have the practical effect of reducing the number of affirmative votes required to obtain a majority vote for each matter by reducing the total number of shares voted from which the majority is calculated.

Since Proposal No. 5 must be approved by the affirmative vote of the holders of at least sixty-six and two-thirds percent (66 2/3%) of the issued and outstanding shares of the Corporation’s common stock entitled to vote at the Annual Meeting, abstentions and broker non-votes will have the effect of a voteAGAINST Proposal No. 5.

Advisory Vote on Executive Compensation

At the Corporation’s 2011 Annual Meeting, the shareholders approved, on an advisory basis, the compensation of the named executive officers, as disclosed in the Corporation’s Proxy Statement for the 2011 Annual Meeting pursuant to the compensation disclosure rules of the Securities and Exchange Commission (the “SEC”), including the 2010 Summary Compensation Table and the other related tables and disclosures. The shareholders also voted to conduct an advisory vote on the Corporation’s executive compensation for named executive officers every three years.

| Page 4 |

Accordingly, the Board has determined that the next shareholder advisory vote on executive compensation will take place at the Corporation’s 2014 Annual Meeting, and the next shareholder advisory vote on the frequency by which shareholders will vote on executive compensation will take place at the 2017 Annual Meeting.

GOVERNANCE OF THE COMPANY

Our Board of Directors believes that the purpose of corporate governance is to ensure that we maximize shareholder value in a manner consistent with legal requirements and the highest standards of integrity. The Board has adopted and adheres to corporate governance practices which the Board and senior management believe promote this purpose are sound and represent best practices.

Board Leadership Structure

The Corporation separates the roles of Chief Executive Officer (“CEO”) and Chairman of the Board (the “Chairman”) in recognition of the differences between the two roles. The CEO is responsible for setting the strategic direction for the Corporation and the day to day operation and performance of the Corporation, while the Chairman provides guidance to the CEO, sets the agenda for Board meetings and presides over meetings of the Board. Mr. Robert E. Bull, our Chairman, has been a director for over 5051 years, including serving as Chairman for the past 3031 years. The Board believes the separated roles of CEO and Chairman are in the best interest of shareholders because it promotes both strategic development and facilitates information flow between management and the Board, both essential for effective governance.

The Corporation’s Board oversees all business, property and affairs of the Corporation. The Chairman and the Corporation’s officers keep the members of the Board informed of the Corporation’s business through discussions at Board meetings and by providing them with reports and other materials. The directors of the Corporation also serve as the directors of the Corporation’s wholly-owned bank subsidiary, First Keystone Community Bank, upon election by the Corporation.

Currently, our Board has nineten members. Based on the qualifications for independence established under the SEC and NASDAQ standards for independence, John E. Arndt, Don E. Bower, Joseph B. Conahan, Jr., Jerome F. Fabian, and David R. Saracino meet the standards for independence. Only independent directors serve on our Audit Committee.

In determining the Directors’ independence, the Board considered loan transactions between the Bank and the directors, their family members and businesses with whom they are associated, as well as any contributions made to non-profit organizations with whom they are associated.

Risk Management

The Board’s role in the Corporation’s risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Corporation, including operational, financial, legal and regulatory, and strategic and reputational risks. The Board receives reports from the various committees of the Board. When a committee presents a report to the full Board, the Chairman of the relevant committee leads the discussion. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships. As part of its charter, the Audit Committee discusses ourthe policies with respect to risk assessment and management.

| Page 5 |

Diversity

In considering whether to recommend any candidate for inclusion in the Board’s slate of recommended director nominees, including candidates recommended by shareholders, the Board has determined that they must have the right diversity. This includes the candidate’s integrity, business acumen, age, experience, commitment, diligence, conflicts of interest and the ability to act in the interests of all shareholders. The Board seeks nominees with a broad diversity of experience, professions, skills, geographic representation and backgrounds. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.

CODE OF ETHICS

As required by law and regulation, in 2003 the Corporation adopted the Directors and Senior Management Code of Ethics (the “Code of Ethics”) to be applicable to our directors and senior management. The Code of Ethics is posted on our website atwww.firstkeystonecorporation.com, which we filed with the SEC as exhibit 14 on Form 8-K on January 11, 2007.

COMMITTEES OF THE BOARD OF DIRECTORS

The Corporation’s Board of Directors has, at present, an Audit Committee.

Audit Committee. Members of the Audit Committee, during 2011,2012, were David R. Saracino, Chairman, Don E. Bower, and Jerome F. Fabian, each of whom the Board has determined satisfies the SEC and NASDAQ independence and audit committee qualification standards. The Audit Committee met seven times during 2011.2012. The principal duties of the Audit Committee are set forth in its charter which is available on our website atwww.firstkeystonecorporation.com under the governance documents menu. The duties include reviewing significant audit and accounting principles, policies and practices, reviewing performance of internal auditing procedures, reviewing reports of examination received from regulatory authorities and recommending annually, to the Board, the engagement of an independent registered public accounting firm.

The Board has determined that David R. Saracino is an “audit committee financial expert” and “independent” as defined under applicable SEC and NASDAQ rules in 2011.2012. The Board deemed Mr. Saracino a “financial expert” as he possesses the following attributes:

Oversight of Executive Compensation and Director Nominations

During 2011,2012, the Corporation did not have formal nominating or compensation committees. The Board determined that it is appropriate for the Corporation not to have a nominating or compensation committee in view of the Corporation’s relative size, stability of the Corporation’s Board, and the historic involvement of the entire Board in the director selection process and in the compensation process. Because there is no formal nominating or compensation committee, the Corporation does not have a formal charter for such committees.

| Page | 6 |

COMMITTEES OF THE BANK

The Bank’s Board maintains standing committees: trust, asset-liabilityasset/liability management, marketing, loan administration, human resources, executive and building. The composition of these committees is described below:

Name |

Trust |

ALCO |

Marketing |

Loan Administration |

Human Resources |

Executive |

Building |

John E. Arndt |

X |

|

X |

X |

X* |

X |

X |

J. Gerald Bazewicz |

|

X |

|

X |

X |

X |

X |

Don E. Bower |

|

|

X |

X* |

X |

|

X |

Robert A. Bull |

X |

X |

X |

X |

|

|

X* |

Robert E. Bull |

|

X |

X |

|

X |

X* |

X |

Joseph B. Conahan, Jr. |

X* |

X |

X |

|

X |

|

|

Jerome F. Fabian |

|

|

X* |

X |

X |

|

X |

John G. Gerlach |

X |

X* |

X |

|

X |

X |

X |

David R. Saracino |

|

X |

|

X |

X |

X |

X |

Number of Meetings Held in 2011 |

14 |

6 |

4 |

4 |

2 |

0 |

5 |

| Name | Trust | ALCO | Marketing | Loan Administration | Human Resources | Executive | Building | |||||||

| John E. Arndt | X | X | X | X* | X | X | ||||||||

| J. Gerald Bazewicz | X | X | X | X | X | |||||||||

| Don E. Bower | X | X* | X | X | ||||||||||

| Robert A. Bull | X | X | X | X | X* | |||||||||

| Robert E. Bull | X | X | X | X* | X | |||||||||

| Joseph B. Conahan, Jr. | X* | X | X | X | ||||||||||

| Jerome F. Fabian | X* | X | X | X | ||||||||||

| John G. Gerlach | X | X* | X | X | X | X | ||||||||

| Matthew P. Prosseda | X | X | X | X | X | X | X | |||||||

| David R. Saracino | X | X | X | X | X | |||||||||

| Number of Meetings Held in 2012 | 12 | 5 | 4 | 4 | 2 | 0 | 1 |

*Denotes Chairman of the Respective Committee.

Trust Committee - This committee ensures that all trust activities of the Bank are performed in a manner that is consistent with the legal instrument governing the account, prudent trust administration practices and approved trust policy.

Asset/Liability Committee (“ALCO”) - This committee reviews asset/liability committee reports and provides support and discretion in managing the Bank’s net interest income, liquidity and interest rate sensitivity positions.

Marketing Committee - This committee provides guidance to management in formulating marketing/sales plans and programs to assist in evaluating the performance of the Bank relative to these plans.

Loan Administration Committee - This committee monitors loan review and compliance activities. Also, the committee ensures that loans are made and administered in accordance with the loan policy.

Human Resources Committee - This committee helps ensure that a sound human resources management system is developed and maintained. This committee determines compensation for non-executive officers and employees. The entire Board acts as the Compensation Committee for the Corporation and determines compensation for the executive officers.

Executive Committee - This committee exercises the authority of the Board of Directors in the management of the business of the Bank between the dates of regular Board meetings if necessary.

| Page |

Building Committee - This committee makes recommendations to the Board relating to the Bank’s physical assets, including both current and proposed physical assets.

Board Meetings and Attendance

The members of the Board of the Corporation also serve as members of the Board of Directors of the Bank. During 2011,2012, the Corporation’s Board held 12 meetings. Each of the directors attended at least 75% of the combined total number of meetings of the Corporation’s Board and the committees of which he is a member. Although there is no formal policy, all directors are expected to attend the Annual Meeting. All Directors attended the 20112012 Annual Meeting.Meeting, except Joseph B. Conahan, Jr.

SHAREHOLDER OR INTERESTED PARTY COMMUNICATIONS

The Board does not have a formal process for shareholders or interested parties to send communications to the Board. Due to the infrequency of shareholder or interested party communications to the Board, the Board does not believe that a formal process is necessary. Any shareholders or interested party may communicate with the Board by sending a letter to: First Keystone Corporation Board of Directors, c/o Corporate Secretary, 111 West Front Street, P.O. Box 289, Berwick, PA 18603. All communications so received from shareholders or other interested parties will be forwarded to the members of the Board or to the applicable director or directors if so designated by such person.

Shareholders or interested parties who have concerns regarding accounting, improper use of Corporation assets, or ethical improprieties may report these concerns to the Audit Committee by sending an email to David R. Saracino, Audit Committee Chairman, atauditcommitteechairman@fkcbank.com.

SHAREHOLDER PROPOSALS AND NOMINATIONS

If a shareholder wants us to include a proposal in the Proxy Statement for presentation at our 20132014 Annual Meeting, the proposal must be received at our principal executive office at 111 West Front Street, P.O. Box 289, Berwick, Pennsylvania 18603, no later than November 29, 2012.2013. Any proposal must comply with SEC regulations regarding the inclusion of shareholder proposals in Corporation-sponsored proxy materials. If a shareholder proposal is submitted to the Corporation after November 29, 2012,2013, it is considered untimely; and, although the proposal may be considered at the Annual Meeting, the Corporation is not obligated to include it in the 20132014 Proxy Statement.

The Corporation’s Board nominates individuals for the position of director. Neither the Corporation nor the Bank has a nominating committee. A shareholder who desires to propose an individual for consideration by the Board as a nominee for director, should submit a proposal in writing to the Secretary of the Corporation in accordance with Section 10.1 of the Corporation’s bylaws. Any shareholder who intends to recommend nomination of any candidate for election to the Board must notify the Secretary of the Corporation in writing not less than 12045 days prior to the date of any meeting of shareholders called for the election of directors and must provide the specific information listed in Section 10.1 of the bylaws. You may obtain a copy of the Corporation’s bylaws by writing to John E. Arndt, Secretary, First Keystone Corporation, 111 West Front Street, P.O. Box 289, Berwick, Pennsylvania 18603. Specifically, a shareholder who recommends a director candidate for consideration to the Board must provide the candidate’s name, biographical data, and qualifications. A written statement from the candidate, consenting to be named as a candidate, and if nominated and elected to serve as a director, should accompany any such recommendation.

| Page | 8 |

The process that the Board uses for identifying and evaluating nominees for director is as follows:follows. When there is a vacancy on the Board, either through the retirement of a director or the Board’s determination that the size of the Board should be increased, nominations to fill that vacancy are made by current directors on the Board. The name of any individual recommended by the directors is provided to Chairman Robert E. Bull, who contacts the prospective director nominee and generally meets with him or her. The members of the Board then may meet with the prospective director nominee. If a nominee is qualified and will make a positive addition to the Board, the Board then nominates the candidate.

PROPOSAL NO. 1: ELECTION OF CLASS AB DIRECTORS

The Corporation’s bylaws provide that its Board will manage the Corporation’s business. Sections 10.2 and 10.3 of the bylaws provide that the number of directors on the Board will not be less than 7 nor more than 25 and that the Board will be classified into 3 classes, each class to be elected for a term of 3 years. Within the foregoing limits, the Board may, from time to time, fix the number of directors and their classifications. No person 75 years or older may serve as director, with the exception of Mr. Robert E. Bull. Section 11.1 of the bylaws require that a majority of the remaining members of the Board, even if less than a quorum, will select and appoint directors to fill vacancies on the Board, and each person so appointed will serve as director until the expiration of the term of office of the class of directors to which he or she was appointed.

Section 10.3 of the bylaws provides for a classified Board with staggered three-year terms of office. Accordingly, at the 20122013 Annual Meeting, threefour Class AB Directors will be elected to serve for a three-year term and until their successors are properly elected and qualified. The Board of the Corporation has nominated the current Class AB Directors to serve as Class AB Directors for the next three-year term of office. The nominees for reelection this year are as follows:

Each nominee has consented to serve a three-year term of office and until his successor is elected and qualified.

Unless otherwise instructed, the proxy holders will vote the proxies for the election of these 34 director nominees. If any nominee should become unavailable for any reason, proxies will be voted in favor of a substitute nominee named by the Board of the Corporation. A majority of the directors of the Corporation, in office, may appoint a new director to fill any vacancy occurring on the Board for any reason, and the new director will serve until the expiration of the term of the class of directors to which he or she was appointed.

The Corporation’s Articles of Incorporation provide that cumulative voting rights do not exist with respect to the election of directors. Accordingly, each share of common stock entitles its owner to cast one vote for each nominee. For example, if a shareholder owns 10 shares of common stock, he or she may cast up to 10 votes for each director to be elected.

The Board of Directors recommends that shareholders voteFOR the election of the above-named director nominees.

| Page |

INFORMATION AS TO DIRECTORS AND NOMINEES

The following selected biographical information about the directors and nominees for director is accurate as of March 1, 2012,2013, and includes each person’s business experience for at least the past 5 years and the experience, qualifications and attributes or skills that led the Board to conclude that the person should serve as a director.

CURRENT CLASS A DIRECTORS WHOSE TERM EXPIRES IN 2012

AND NOMINEES FOR CLASS A DIRECTOR WHOSE TERM WILL EXPIRE IN 2015

CLASS B DIRECTORS WHOSE TERM EXPIRES IN 2013

AND NOMINEES FOR CLASS B DIRECTOR WHOSE TERM WILL EXPIRE IN 2016

| JohnE. Arndt | Mr. Arndt (age |

| J.Gerald Bazewicz | Mr. Bazewicz (age |

| RobertE. Bull(1) | Mr. Bull (age |

| Joseph B. Conahan, Jr. | Dr. Conahan (age |

CLASS C DIRECTORS WHOSE TERM EXPIRES IN 2014

| CLASS C DIRECTORS WHOSE TERM EXPIRES IN 2014 | ||

| Don E. Bower | Mr. Bower (age | |

| Robert A. Bull(1) | Mr. Bull (age | |

| Page 10 |

| Matthew P. Prosseda | Mr. Prosseda (age 51), serves as the President and Chief Executive Officer of the Corporation and the Bank, a position he has held since 2012. He has served as a director of the Corporation and the Bank since 2012. Previously, Mr. Prosseda was the Chief Executive Officer of the Corporation and the Bank from 2010 to 2012. Prior to that date, Mr. Prosseda served as Executive Vice President and Assistant Secretary from 2005 until 2010. | |

| CLASS A DIRECTORS WHOSE TERM EXPIRES IN 2015 | ||

| Jerome F. Fabian | Mr. Fabian (age 70), is the President and owner of Tile Distributors of America, Inc., located in Wilkes-Barre, Pennsylvania. He has served as a director of the Corporation and the Bank since 1998. Mr. Fabian has been a successful entrepreneur with extensive sales and marketing experience. | |

| John G. Gerlach | Mr. Gerlach (age 71), is the retired President of the Pocono division of First Keystone Community Bank and the former President of Pocono Community Bank. He has been a director of the Corporation and the Bank since 2007. Previously, he was a director of Pocono Community Bank since 1997. Mr. Gerlach has over 41 years of banking experience. He possesses strong banking knowledge and served on the Board of Directors of the Federal Reserve Bank of Philadelphia. | |

| David R. Saracino | Mr. Saracino (age 68), is the former Vice President, Cashier, and Chief Financial Officer of First Keystone Community Bank. Mr. Saracino has served as a director of the Corporation and the Bank since 2006. He has excellent accounting skills and has been deemed our “financial expert” on the Audit Committee of the Corporation. | |

(1)Robert E. Bull is the father of Robert A. Bull.

At the Corporation’s and Bank’s annual reorganization meetings in May following the Annual Meeting, the Board currently anticipate that they will appoint Matthew P. Prosseda, Chief Executive Officer of the Corporation and the Bank, as President and Chief Executive Officer of the Corporation and the Bank. In addition, at the same reorganization meetings, the Board expects to appoint Mr. Prosseda as a Class C Director of the Corporation to serve until the 2014 Annual Meeting or until his successor is properly elected and qualified and a director of the Bank. This action is taken consistent with the Corporation’s bylaws where appointed directors serve the remaining term for the class in which they are appointed.

| Page |

SHARE OWNERSHIP

Principal Owners

The following table sets forth, as of March 1, 2012,2013, the name and address of each person who owns of record or who is known by the Board to be the beneficial owner of more than 5% of the Corporation’s outstanding common stock, the number of shares beneficially owned by the person and the percentage of the Corporation’s outstanding common stock so owned.

| Percent of Outstanding | ||||||||

| Amount and Nature of | Common Stock | |||||||

| Name and Address | Beneficial Ownership1 | Beneficially Owned | ||||||

| Berbank | 275,722 | 2 | 5.06 | % | ||||

| First Keystone Community Bank | ||||||||

| Trust Department | ||||||||

| 111 West Front Street | ||||||||

| Berwick, PA 18603 | ||||||||

| Percent of Outstanding | ||||||||

| Amount and Nature of | Common Stock | |||||||

| Name and Address | Beneficial Ownership1 | Beneficially Owned | ||||||

| Berbank | 273,1592 | 5.00 | % | |||||

| First Keystone Community Bank | ||||||||

| Trust Department | ||||||||

| 111 West Front Street | ||||||||

| Berwick, PA 18603 | ||||||||

___________________

1 The securities “beneficially owned” by an individual are determined in accordance with the definitions of “beneficial ownership” set forth in the General Rules and Regulations of the SEC and may include securities owned by or for the individual’s spouse and minor children and any other relative who has the same home, as well as securities to which the individual has or shares voting or investment power or has the right to acquire beneficial ownership within 60 days after March 1, 2012.2013. Beneficial ownership may be disclaimed as to certain of the securities.

2 Nominee registration for the common stock held by the Trust Department of the Bank (“Berbank”) on behalf of various trusts, estates and other accounts for which the bank acts as fiduciary with sole voting and dispositive power over 212,857210,134 shares and as fiduciary with shared voting and dispositive power over 62,86563,025 shares. Total does not include 255,296233,879 shares held by the Trust Department of the Bank for which the Bank does not have sole or shared voting or dispositive power. The Trust Department intends to cast all shares under its voting power in accordance withfor the Board’s recommendations with respect to Proposal Nos. 1, 2, 3, 4election of the nominees for director named below and 5.for the ratification of J. H. Williams & Co., LLP, independent accountants of the Corporation.

| Page 12 |

Beneficial Ownership by Officers, Directors and Nominees

The following table sets forth, as of March 1, 2012,2013, the amount and percentage of the outstanding common stock beneficially owned by each director, nominee for director, and other named executive officers of the Corporation. The table also indicates the total number of shares owned by all directors, nominees for director, and named executive officers of the Corporation and the Bank as a group. A person owns his or her shares directly as an individual unless otherwise indicated.

| Number of | ||||||||

| Name | Shares Owned1, 2 | Percentage3 | ||||||

| Nominees for Class B Directors | ||||||||

| (to serve until 2016) | ||||||||

| And Class B Directors | ||||||||

| John E. Arndt | 17,716 | 4 | — | |||||

| J. Gerald Bazewicz | 33,684 | 5 | — | |||||

| Robert E. Bull | 161,127 | 6 | 2.94 | % | ||||

| Joseph B. Conahan, Jr. | 61,641 | 7 | 1.12 | % | ||||

| Class C Directors (to serve until 2014) | ||||||||

| Don E. Bower | 87,164 | 8 | 1.59 | % | ||||

| Robert A. Bull | 88,418 | 9 | 1.61 | % | ||||

| Matthew P. Prosseda | 7,659 | 10 | — | |||||

| Class A Directors (to serve until 2015) | ||||||||

| Jerome F. Fabian | 47,749 | 11 | — | |||||

| John G. Gerlach | 9,477 | 12 | — | |||||

| David R. Saracino | 8,825 | 13 | — | |||||

| Named Executive Officers | ||||||||

| Kevin L. Miller | 3,321 | 14 | — | |||||

| Diane C. A. Rosler | 2,810 | 15 | — | |||||

| Elaine A. Woodland | 2,273 | 16 | — | |||||

| Barbara J. Robbins | 5,293 | 17 | — | |||||

| All Directors and Named Executive | ||||||||

| Officers as a Group (14 Persons in Total) | 537,157 | 9.80 | % | |||||

| Number of | ||||||||

| Name | Shares Owned1, 2 | Percentage3 | ||||||

| Nominees for Class A Directors | ||||||||

| (to serve until 2015) | ||||||||

| And Class A Directors | ||||||||

| Jerome F. Fabian | 45,799 | 4 | — | |||||

| John G. Gerlach | 9,477 | 5 | — | |||||

| David R. Saracino | 8,825 | 6 | — | |||||

| Class B Directors (to serve until 2013) | ||||||||

| John E. Arndt | 11,073 | 7 | — | |||||

| J. Gerald Bazewicz | 33,510 | 8 | — | |||||

| Robert E. Bull | 169,004 | 9 | 3.10 | % | ||||

| Joseph B. Conahan, Jr. | 61,441 | 10 | 1.13 | % | ||||

| Class C Directors (to serve until 2014) | ||||||||

| Don E. Bower | 83,263 | 11 | 1.51 | % | ||||

| Robert A. Bull | 83,512 | 12 | 1.52 | % | ||||

| Named Executive Officers | ||||||||

| Matthew P. Prosseda | 7,434 | 13 | — | |||||

| Kevin L. Miller | 3,257 | 14 | — | |||||

| Diane C. A. Rosler | 2,786 | 15 | — | |||||

| Elaine A. Woodland | 2,146 | 16 | — | |||||

| Barbara J. Robbins | 5,234 | 17 | — | |||||

| All Directors and Named Executive | ||||||||

| Officers as a Group (14 Persons in Total) | 526,761 | 9.67 | % | |||||

____________________

1The securities “beneficially owned” by an individual are determined in accordance with the definitions of “beneficial ownership” set forth in the General Rules and Regulations of the SEC and may include securities owned by or for the individual’s spouse and minor children and any other relative who has the same home, as well as securities to which the individual has or shares voting or investment power or has the right to acquire beneficial ownership within 60 days after March 1, 2012.2013. Beneficial ownership may be disclaimed as to certain of the securities.

2Information furnished by the directors and the Corporation.

3Less than 1% unless otherwise indicated. Based on 5,446,0375,480,217 shares outstanding as of March 1, 2012.2013.

4Includes 8,79914,852 shares held individually by Mr. Fabian, 16,912 shares by the Jerome F. Fabian Trust Under Agreement for which Mr. Fabian exercises dispositive power, and 20,088Arndt, 2,016 shares held jointly withindividually by his spouse.spouse, and 848 shares held as custodian for his children.

| Page |

5Includes 1,250 shares held individually by Mr. Gerlach and 8,227 shares held jointly with his spouse.

6Includes 8,825 shares held individually by Mr. Saracino.

7Includes 8,809 shares held individually by Mr. Arndt, 1,500 shares held individually by his spouse, and 764 shares held as custodian for his children.

8Includes 26,44126,593 shares held individually by Mr. Bazewicz, 6,559 shares held jointly with his spouse and 510532 shares held individually by his spouse.

96Includes 80,09571,995 shares held individually by Mr. R.E. Bull, 5,2395,462 shares held by Bull, Bull & Knecht,McDonald, LLP, a law firm of which Mr. Bull is a partner, and 83,670 shares held by the Sara E. Bull Decedent Estate Trust of which Mr. Bull is the trustee.

107Includes 41,449 shares held individually by Dr. Conahan and 19,99220,192 shares held jointly with his spouse.

118Includes 81,67285,503 shares held individually by Mr. Bower, 755787 shares held jointly with his spouse, and 836874 shares held as custodian for his grandchildren. Includes 20,139 pledged shares.

129Includes 31,40533,192 shares held individually by Mr. R.A. Bull, 5,2395,462 shares held by Bull, Bull & Knecht,McDonald, LLP, a law firm of which Mr. Bull is a partner, 38,17840,704 shares held jointly with his spouse, and 8,6909,060 shares held individually by his spouse.

1310Includes 4,2295,545 shares held individually by Mr. Prosseda 1,930and 2,114 shares held in his Bank 401(k) plan.

11Includes 9,173 shares held individually by Mr. Fabian, 17,632 shares by the Jerome F. Fabian Trust Under Agreement for which Mr. Fabian exercises dispositive power, and 20,944 shares held jointly with his spouse.

12Includes 1,250 shares held individually by Mr. Gerlach and 8,227 shares held jointly with his spouse.

13Includes 8,825 shares held individually by Mr. Saracino.

14Includes 1,054 shares held individually by Mr. Miller, 980 shares held in his Bank 401(k) plan and 1,275 shares which may be purchased upon the exercise of stock options.

14Includes 626 shares held individually by Mr. Miller, 951 shares held in his Bank 401(k) plan and 1,6801,287 shares which may be purchased upon the exercise of stock options.

15Includes 1,199 shares held individually by Ms. Rosler, 800824 shares held in her Bank 401(k) plan and 787 shares which may be purchased upon the exercise of stock options.

16Includes 606632 shares held individually by Ms. Woodland, 96101 shares held jointly with her spouse, 9441,040 shares held in her Bank 401(k) plan and 500 shares which may be purchased upon the exercise of stock options.

17Includes 8261,613 shares held individually by Ms. Robbins, 390 shares held jointly with her spouse, 1,9442,003 shares held in her Bank 401(k) plan and 2,0741,287 shares which may be purchased upon the exercise of stock options.

| Page | 14 |

DIRECTORS’ COMPENSATION TABLE

| Name | Fees Earned or Paid in Cash ($) | Stock Awards | Option Awards | Non-Equity Incentive Plan Compen- sation | Change in Pension Value and Non-qualified Deferred Compen- sation Earnings | All Other Compen- sation ($) | Total ($) | Fees Earned or Paid in Cash ($) | Stock Awards | Option Awards | Non-Equity Incentive Plan Compen- sation | Change in Pension Value and Non-qualified Deferred Compen- sation Earnings | All Other Compen -sation ($) | Total ($) | ||||||||||||||||||||||||||||||||||||||||||

| John E. Arndt | 33,350.00 | — | — | — | — | — | 33,350.00 | 37,400 | — | — | — | — | — | 37,400 | ||||||||||||||||||||||||||||||||||||||||||

| J. Gerald Bazewicz | 32,600.00 | — | — | — | — | — | 32,600.00 | 34,800 | — | — | — | 28,505 | 45,000 | 1 | 108,305 | |||||||||||||||||||||||||||||||||||||||||

| Don E. Bower | 30,500.00 | — | — | — | — | — | 30,500.00 | 34,400 | — | — | — | — | — | 34,400 | ||||||||||||||||||||||||||||||||||||||||||

| Robert A. Bull | 34,700.00 | — | — | — | — | — | 34,700.00 | 38,800 | — | — | — | — | — | 38,800 | ||||||||||||||||||||||||||||||||||||||||||

| Robert E. Bull | 37,700.00 | — | — | — | — | — | 37,700.00 | 41,100 | — | — | — | — | — | 41,100 | ||||||||||||||||||||||||||||||||||||||||||

| Joseph B. Conahan, Jr. | 32,950.00 | — | — | — | — | — | 32,950.00 | 34,800 | — | — | — | — | — | 34,800 | ||||||||||||||||||||||||||||||||||||||||||

| Jerome F. Fabian | 30,500.00 | — | — | — | — | — | 30,500.00 | 32,800 | — | — | — | — | — | 32,800 | ||||||||||||||||||||||||||||||||||||||||||

| John G. Gerlach | 30,650.00 | — | — | — | — | — | 30,650.00 | 36,400 | — | — | — | — | — | 36,400 | ||||||||||||||||||||||||||||||||||||||||||

| David R. Saracino | 32,600.00 | — | — | — | — | — | 32,600.00 | 34,800 | — | — | — | 14,802 | 28,000 | 1 | 77,602 | |||||||||||||||||||||||||||||||||||||||||

1Represents deferred compensation payments made under a salary continuation agreement.

Compensation of Directors

During 2011,2012, each member of the Corporation’s Board received $700$800 for his attendance at the Annual Meeting. Other corporate Board meetings met concurrently with the Bank’s Board, and directors received no additional compensation. The Bank’s directors received $700$800 for each directors’ meeting attended. Non-employee directors received a $5,000 retainer and $350$400 for each committee meeting attended. Chairman Bull received an annual stipend of $1,000$1,500 and Secretary Arndt received an annual stipend of $750.$1,000. Each director is entitled to reimbursement for out-of-pocket expenses to attend meetings. In addition, each director received a $1,000 bonus. In the aggregate, the Board received $295,550$339,100 for all Board meetings and committee meetings attended in 2011,2012, including all fees and stipends paid to all directors in 2011.2012.

Messrs. Bazewicz and Saracino are parties to salary continuation agreements which were entered into when each respective individual was a key employee of the Bank. Both agreements vested upon the executive’s retirement after age 60. Both individuals receive benefits for a total of twenty years in the amount disclosed above.

| Page 15 |

REPORT OF THE AUDIT COMMITTEE

The Audit Committee oversees the Corporation’s financial reporting process on behalf of the Board. In that connection, the committee, along with the Board, has formally adopted an audit committee charter setting forth its responsibilities.

Management has the primary responsibility for the financial statements and the reporting process including the systems of internal control. In fulfilling its oversight responsibilities, the committee reviewed the audited financial statements in the Annual Report on Form 10-K with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The committee reviewed with the Independent Accountants, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Corporation’s accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards. In addition, the committee has discussed with the Independent Accountants, their independence from management and the Corporation including the matters in written disclosures required by the statement on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting Oversight Board in Rule 3200T and considered the compatibility of non-audit services with the accountants’ independence.

The committee discussed the overall scope and plans for their audits with the Corporation’s internal auditors and Independent Accountants. The committee meets with the internal auditors and Independent Accountants, with and without management present, to discuss the results of their examinations, their evaluations of the Corporation’s internal controls and the overall quality of the Corporation’s financial reporting. The Corporation believes that it has established appropriate policies and procedures to comply with requirements of the Sarbanes-Oxley Act of 2002. The committee held 7 meetings during fiscal year 2011.2012.

With respect to the Corporation’s Independent Accountants, the committee, among other things, discussed with J.H. Williams & Co., LLP matters relating to its independence, including the written disclosures made to the committee by the Independent Accountants and the letter from the Independent Accountants as required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent public accounting firm’sIndependent Accountant’s communications with the Audit Committee concerning independence.

In reliance on the reviews and discussions referred to above, the committee recommended to the Board (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 20112012 for filing with the SEC. The committee and the Board have also approved the selection of the Corporation’s independent public accounting firmIndependent Accountants for 2012.2013.

| Page 16 |

Aggregate fees billed to the Corporation and the Bank by J. H. Williams & Co., LLP for services rendered during the years ended December 31, 20112012 and 20102011 were as follows:

| Year Ended December 31, | Year Ended December 31, | |||||||||||||||

| 2011 | 2010 | 2012 | 2011 | |||||||||||||

| Audit fees1 | $ | 105,000 | $ | 100,500 | $ | 106,908 | $ | 106,838 | ||||||||

| Tax fees2 | 10,000 | 9,500 | 10,000 | 10,000 | ||||||||||||

| Total | $ | 115,000 | $ | 110,000 | $ | 116,908 | $ | 116,838 | ||||||||

___________________

1Audit Fees include fees billed for professional services rendered for the audit of annual financial statement and fees billed for the review of financial statements included in the Corporation’s Forms 10-Q or services that are normally provided by J. H. Williams & Co., LLP in connection with statutory and regulatory filings or engagements.

2Tax Fees include fees billed for professional services rendered by J. H. Williams & Co., LLP for tax compliance. These services include preparation of Federal and State Annual Tax Returns for the Corporation.Corporation and the Bank.

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Accountants

The Audit Committee pre-approves all audit and permissible non-audit services provided by the Independent Accountants. These services may include audit services, audit related services, tax services, and other services. The Audit Committee has adopted a policy for the pre-approval of services provided by the Independent Accountants. Under the policy, pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is subject to a specific Board approved budget. In addition, the Audit Committee may also pre-approve particular services on a case by case basis. For each proposed service, the Independent Accountant is required to provide a detailed engagement letter.

The committee is comprised of three directors, all of whom are considered “independent” as defined by SEC Rules and NASDAQ listing standards. The Board has determined that no member of the committee has a relationship with the Corporation that should interfere with his independence from the Corporation or its management.

The foregoing report has been furnished by the current members of the committee.

| Members of the Audit Committee | |

| David R. Saracino, Chairman | |

| Don E. Bower | |

| Jerome F. Fabian |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

The Board serves as the Compensation Committee for the Bank and develops the Bank’s and the Corporation’s executive compensation policy. The Board also determines the named executive officers’ individual compensation. For 2011,2012, the named executive officers were Matthew P. Prosseda, Kevin L. Miller, Diane C.A. Rosler, Elaine A. Woodland and Barbara J. Robbins.

| Page 17 |

Compensation Objectives and Program Design

For the fiscal year 2011,2012, executive compensation included base salary, the opportunity for cash bonuses and the ability to participate in the Bank’s health and welfare plans and the Bank’s retirement plan.

The compensation program is designed to reward the named executive officers based on their level of assigned management responsibilities and individual performance levels.

The basic mission onof the Corporation’s executive compensation policy is to provide executives with a competitive compensation package that attracts and retains qualified executives while placing a portion of total pay at risk. The at risk element of compensation, the Management Incentive Compensation Plan, may have no value or may be worth less than the target value if goals are not met.

Executive Officers’ Role in Determining Compensation

The Board, acting as the Compensation Committee, considers information provided by the Chief Executive Officer in determining the appropriate level of compensation for other named executive officers. Individual performance objectives are set by the Chief Executive Officer and a year-end appraisal on each named executive officer prepared by the Chief Executive Officer is reviewed by the Board. No named executive officer other than the Chief Executive Officer attends those portions of the Board meetings during which the performance of the other named executive officers is evaluated or their compensation is being determined.

The Chief Executive Officer is not present during the Compensation Committee’s discussion of his performance and compensation.

Compensation Consultant

In 2011,2012, a compensation consultant did not play a role in setting compensation or advising on specific compensation. The Compensation Committee reviewed the L. R. Webber Associates, Inc.’s 20112012 Salary/Benefits for Financial Institutions Survey (“the Survey”) to acquaint itself with current trends and practices in compensation.

Benchmarking

The Compensation Committee reviewed the data contained in the L. R. Webber Associates, Inc.’s 2011 Salary/Benefits for Financial InstitutionsSurvey. The Survey (“the Survey”).provides information in ranges by job position. The peer group of financial institutions chosen by the Board for purposes of making a comparative analysis of executive compensation does include some of the same financial institutions incorporated in the peer group established to compare shareholder returns as indicated in the performance graph included in the Annual Report on Form 10-K.

| Page 18 |

The financial institutions chosen for the Survey included nine banks with assets generally between $500 million and $1 billion with headquarters located in Northeastern and Central Pennsylvania. They included:

| • | 1st Summit Bank (Johnstown) |

After reviewing the base salaries and benefits provided in the Survey, no adjustments to compensation were made in 2011,2012, other than the normal annual salary increases. The goal of the Corporation is to compensate at approximately the average range mid-point for each job classification with the at risk portion of compensation to reward favorable overall bank earnings performance. The named executive officer positions were reviewed and three of the five fall below the mid-point range.

Shareholder Vote

The Compensation Committee reviewed and considered the shareholder response to the Say-On-Pay Vote at the 20112012 Annual Meeting. Based upon the results of the shareholder Say-On-Pay Vote, the Compensation Committee acknowledged the shareholders’ approval of the Corporation’s and Bank’s compensation policies and did not make any adjustments thereto.

Base Salary

The executive compensation established by the Compensation Committee is based upon its overall subjective assessment of the value of the services provided by each named executive officer with consideration given to performance factors and peer group compensation information.

For the base salary paid to named executive officers other than the Chief Executive Officer, the Compensation Committee considers information provided by the Chief Executive Officer as to each executive officer’s level of individual performance, contribution to the organization, scope of responsibilities, salary history and general market levels gathered from the compensation survey.Survey.

For the base salary paid to the Chief Executive Officer, the Compensation Committee, with the Chief Executive Officer not being present, considers his performance level, the results of management decisions made by him and the earnings of the organization. The Compensation Committee reviews the return on assets and return on equity when making the subjective determination of whether or not the Chief Executive Officer’s base pay should be at the median, below the median, or above the median provided in the compensation survey. No particular weight is assigned to any of the foregoing individual performance factors and no specific performance targets are used in determining whether an increase in base salary is warranted.

| Page 19 |

Decisions regarding base salary are made without consideration of other forms of compensation provided. Bonuses are intended to provide additional incentive to the named executive officers to achieve a higher level of success. Adjusting the base salary to correspond with the amount of the bonuses would defeat the purpose of having at risk compensation.

Cash Bonuses

The purpose of the Management Incentive Compensation Plan (the “Plan”) is to provide incentives and awards to top management employees who, through high levels of performance, contribute to the success and profitability of the bank. Participation in the Plan is limited to the executive management team. This management team includes the following functional job titles: Chief Executive Officer, Chief Operating Officer, Senior Vice President and Chief Financial Officer, Senior Vice President and Deposit Operations Manager, and Executive Vice President and Director of Lending. The management incentive pool created after the achievement of a required budget net income is distributed to the executive management team as follows:

| Chief Executive Officer | 45 | % | ||

| Chief Operating Officer | 25 | % | ||

| Senior Vice President and Chief Financial Officer | 10 | % | ||

| Senior Vice President and Deposit Operations Manager | 10 | % | ||

| Executive Vice President and Director of Lending | 10 | % |

The Plan serves as a short termshort-term incentive that aligns executive pay with the annual performance of the Corporation and is earned through the achievement of overall annual earnings objectives. It aligns management’s interestinterests with those of the shareholders because, generally, the higher the net income for the year, the larger the bonuses paid to management. The Plan is also designed to support organizational objectives and financial goals, as defined by the Bank’s Strategic and Financial Plans, by making available additional, variable and contingent incentive compensation.

The Plan is also established to augment regular salary and benefits programs already in existence. It is not meant to be a substitute for salary increases, but as a supplement to salary, and, as stated earlier, as an incentive for performance that contributes to outstanding levels of achievement.

Supplemental Employee Retirement Plan

The Supplemental Employee Retirement Plan (the “SERP”) rewards certain named executive officers for their long-term contributions to the bank. To encourage Mr. Prosseda and Ms. Woodland to continue their employment with the Corporation until retirement, the Compensation Committee believed it to be in the best interests of the Corporation and Bank to enter into salary continuation agreements with them. The agreements were also established to reward certain executivesthem for past and future services to the Corporation. The Compensation Committee believes the income benefit amounts are reasonable and consistent with the compensation standards of Section 39 of the Federal Deposit Insurance Company Improvement Act of 1991 and the related implementing regulations. Another benefit to the Bank from having the SERP is that it contains a restrictive covenant prohibiting the executive from competing with the Bank while receiving benefits under the SERP, except after a change of control.

Employee Benefits Provided to Eligible Employees

All named executive officers participate in the Bank’s retirement plan and health and welfare plans that are offered to other eligible employees of the Bank. Retirement and health and welfare benefits are not tied to Corporation, Bank, or individual performance. The cost of providing such benefits is not taken into account when determining specific salaries of the named executive officers and is seen as a cost of doing business.

| Page 20 |

Retirement Plan

The Compensation Committee believes that it is essential for employees to save for retirement and as such has provided all employees a vehicle through which to do so by maintaining a 401(k) plan, which has a combined tax qualified savings feature and profit sharing feature.

Health and Welfare Plans

Group life insurance, group disability, vision benefits and health insurance are available to all employees, as well isas an IRS Section 125 plan. Such plans are standard in the industry and in the geographic area for all industries and necessary to compete for talented employees at all levels of the Corporation. Named executive officers participate in these plans under the same terms and conditions as other employees.

Health insurance premiums are partially paid by employees through payroll deductions for the employee share of the health care cost.

Triggering Events In Contracts

Presently, there are no named executive officers who are parties to employment or consulting agreements with the Corporation.

Under the SERP to which both Mr. Prosseda and Ms. Woodland are parties, the triggering events are change of control, retirement, disability, involuntary termination and death.

The Compensation Committee believes that the triggering events in these agreements are appropriate in that they encourage executives to act in the best interests of the shareholders in evaluating any change of control opportunities and it keeps the executives focused on running the Corporation in the face of real or rumored corporate transactions. The Compensation Committee also believes that it is appropriate to provide the named executive officers a benefit under the SERP in the event the executive becomes disabled and a benefit to his or her beneficiaries in the event of his or her death as consideration for the executive’s past employment with the Bank. Additionally, as the SERP is a benefit upon which the executive will rely upon for retirement income, the Compensation Committee understands that it is important to provide the executive with a reduced benefit under the SE RPSERP if the executive is terminated without cause before retirement age.

Accounting and Tax Treatments

Sections 162(m) of the Internal Revenue Code generally limits the tax deductibility of compensation paid in one year to highly compensated employees to $1 million. Given the current level of compensation, the Compensation Committee does not feel that it is necessary to have a formal policy with regard to Section 162(m). There were no accounting treatments which were considered in establishing the Compensation Policy.

Material Differences in Named Executive Officers’ Compensation

The named executive officers are compensated based upon their respective position and longevity with the Bank. All named executive officers participate in the retirement and health insurance benefits provided to all employees on the same terms as all other employees. The difference in the named executive officers’ base salary is premised upon their position, experience, and individual performance. Only Mr. Prosseda and Ms. Woodland are provided SERP agreements as a result of Mr. Prosseda’s role as Chief Executive Officer and as a result of Ms. Woodland’s role as Director of Lending of the Bank.

| Page 21 |

Conclusion

The Compensation Committee believes the amount and types of compensation provided to the named executive officers are competitive and appropriate for the Corporation to attain its short and long-term objectives and goals. The compensation programs are designed to provide an incentive to the named executive officers on both a short-term and long-term basis. The programs have been tailored by the Corporation so that the various elements of compensation align the interests of our shareholders and those of the named executive officers to maximize shareholder value.

Compensation Committee Report

The Board, acting as the Compensation Committee, has reviewed and discussed the Compensation Discussion and Analysis with management, and based on the review and discussions, the Board concluded that the Compensation Discussion and Analysis be included in the Corporation’s Proxy Statement.

Board of Directors

| Robert E. Bull, Chairman | Robert A. Bull |

| J. Gerald Bazewicz, Vice Chairman | Dr. Joseph B. Conahan, Jr. |

| Jerome F. Fabian | |

| John E. Arndt, Secretary | John G. Gerlach |

| Don E. Bower | David R. Saracino |

Compensation Committee Interlocks and Insider Participation

The Board, which includes J. Gerald Bazewicz,Matthew P. Prosseda, President and Chief Executive Officer, functions as the Compensation Committee. For compensation paid to executive officers other than the Chief Executive Officer, the Board of Directors considers information provided by the Chief Executive Officer. For compensation paid to the Chief Executive Officer, the Board of Directors, with Mr. Prosseda not being present, determines his compensation, as outlined above under “Base Salary”.

Executive Compensation

During the beginning of 2011,2012, the Board conducted a risk assessment of the Bank’s compensation program. The Board concluded that the program is balanced, does not motivate imprudent risk taking, and is not reasonably likely to have a material adverse effect on the Bank.

The table below shows information concerning the annual and long-term compensation for services rendered in all capacities to the Corporation and the Bank for the fiscal year ended

December 31, 20112012 of those persons who were:

| Page | 22 |

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

| Name and Principal Position | Year | Salary ($) | Bonus ($)1 | Stock Awards ($) | Option Awards ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Change in | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pension | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Value and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nonqualified | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Name and | Stock | Option | Compensation | All Other | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal | Salary | Bonus | Awards | Awards | Earnings | Compensation | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Position | Year | ($) | ($)1 | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Matthew P. Prosseda | 2011 | 198,462 | 33,750 | — | — | 26,232 | 22,649 | 2 | 281,093 | 2012 | 210,000 | 30,060 | — | — | 27,850 | 38,175 | 2 | 306,085 | ||||||||||||||||||||||||||||||||||||||||||||||

| Chief Executive Officer | 2010 | 169,539 | 22,500 | — | — | 24,709 | 16,954 | 2 | 233,702 | 2011 | 198,462 | 33,750 | — | — | 26,232 | 22,649 | 2 | 281,093 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2009 | 157,000 | — | — | — | 23,272 | 17,691 | 2 | 197,963 | 2010 | 169,539 | 22,500 | — | — | 24,709 | 16,954 | 2 | 233,702 | |||||||||||||||||||||||||||||||||||||||||||||||

| Diane C. A. Rosler | 2011 | 100,000 | 7,500 | — | — | — | 11,019 | 3 | 118,519 | 2012 | 108,000 | 6,680 | — | — | — | 11,550 | 3 | 126,230 | ||||||||||||||||||||||||||||||||||||||||||||||

| Chief Financial Officer | 2010 | 85,654 | 7,500 | — | — | — | 8,566 | 3 | 101,720 | 2011 | 100,000 | 7,500 | — | — | — | 11,019 | 3 | 118,519 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2009 | 80,000 | — | — | — | — | 8,793 | 3 | 88,793 | 2010 | 85,654 | 7,500 | — | — | — | 8,566 | 3 | 101,720 | |||||||||||||||||||||||||||||||||||||||||||||||

| Kevin L. Miller | 2011 | 119,938 | 18,750 | — | — | — | 13,351 | 4 | 152,039 | 2012 | 134,640 | 16,700 | — | — | — | 15,339 | 4 | 166,679 | ||||||||||||||||||||||||||||||||||||||||||||||

| Chief Operating Officer | 2010 | 99,038 | 10,313 | — | — | — | 9,904 | 4 | 119,255 | 2011 | 119,938 | 18,750 | — | — | — | 13,351 | 4 | 152,039 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2009 | 98,038 | — | — | — | — | 10,359 | 4 | 108,397 | 2010 | 99,038 | 10,313 | — | — | — | 9,904 | 4 | 119,255 | |||||||||||||||||||||||||||||||||||||||||||||||

| Elaine A. Woodland | 2011 | 135,131 | 7,500 | — | — | 14,366 | 13,851 | 5 | 170,848 | 2012 | 142,695 | 6,680 | — | — | 15,252 | 15,020 | 5 | 179,647 | ||||||||||||||||||||||||||||||||||||||||||||||

| Director of Lending | 2010 | 132,500 | — | — | — | 13,531 | 13,250 | 5 | 159,281 | 2011 | 135,131 | 7,500 | — | — | 14,366 | 13,851 | 5 | 170,848 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2009 | 131,758 | — | — | — | 12,745 | 13,176 | 5 | 157,679 | 2010 | 132,500 | — | — | — | 13,531 | 13,250 | 5 | 159,281 | |||||||||||||||||||||||||||||||||||||||||||||||

| Barbara J. Robbins | 2011 | 85,000 | 7,500 | — | — | — | 9,481 | 6 | 101,981 | 2012 | 91,800 | 6,680 | — | — | — | 9,930 | 6 | 108,410 | ||||||||||||||||||||||||||||||||||||||||||||||

| Deposit Operations Manager | 2010 | 80,000 | 7,500 | — | — | — | 8,000 | 6 | 95,500 | 2011 | 85,000 | 7,500 | — | — | — | 9,481 | 6 | 101,981 | ||||||||||||||||||||||||||||||||||||||||||||||

| 2009 | 79,962 | — | — | — | — | 8,801 | 6 | 88,763 | 2010 | 80,000 | 7,500 | — | — | — | 8,000 | 6 | 95,500 | |||||||||||||||||||||||||||||||||||||||||||||||

1Bonus earned in 2012 paid in 2013, bonus earned in 2011 paid in 2012 and bonus earned in 2010 paid in 2011.

2Amounts shown for Mr. Prosseda in 2012 include $13,800 in director fees, $7,313 401(k) matching and $17,062 401(k) profit sharing award, in 2011 include $6,629 401(k) matching contribution and $16,020 401(k) profit sharing award and in 2010 $5,086 401(k) matching contribution and $11,868 401(k) profit sharing award, and in 2009 $5,307 401(k) matching contribution and $12,384 401(k) profit sharing award.

3Amounts shown for Ms. Rosler in 2012 include $3,465 401(k) matching and $8,085 401(k) profit sharing award, in 2011 include $3,225 401(k) matching contribution and $7,794 401 (k)401(k) profit sharing award and in 2010 $2,570 401(k) matching contribution and $5,996 401(k) profit sharing award, and in 2009 $2,638 401(k) matching contribution and $6,155 401(k) profit sharing award.

4Amounts shown for Mr. Miller in 2012 include $4,602 401(k) matching and $10,737 401(k) profit sharing award, in 2011 include $3,908 401(k) matching contribution and $9,443 401(k) profit sharing award and in 2010 $2,971 401(k) matching contribution and $6,933 401(k) profit sharing award, and in 2009 $3,108 401(k) matching contribution and $7,251 401(k) profit sharing award.

5Amounts shown for Ms. Woodland in 2012 include $4,506 401(k) matching and $10,514 profit sharing award, in 2011 include $4,054 401(k) matching contribution and $9,797 401(k) profit sharing award and in 2010 $3,975 401(k) matching contribution and $9,275 401(k) profit sharing award, and in 2009 $3,953 401(k) matching contribution and $9,223 401(k) profit sharing award.

6 Amounts shown for Ms. Robbins in 2012 include $2,979 401(k) matching and $6,951 401(k) profit sharing award, in 2011 include $2,775 401(k) marchingmatching contribution and $6,706 401(k) profit sharing award and in 2010 $2,400 401(k) matching contribution and $5,600 401(k) profit sharing award, and in 2009 $2,640 401(k) matching contribution and $6,161 401(k) profit sharing award.

| Page |

401(k) Plan

The Bank maintains a 401(k) Plan which has a combined tax qualified savings feature and profit sharing feature. The plan provides benefits to employees who have completed at least one year of service and are at least 21 years of age. The plan agreement provides that the bankBank will match employee deferrals to the plan up to 3% of their respective eligible compensations. Additionally, the bankBank may make a discretionary profit sharing contribution annually to the plan. Contributions made by the bankBank to the plan are allocated to participants in the same portionsportion that each participant’s compensation bears to the aggregate compensation of all participants. Each participant in the plan is 100% vested at all times. Benefits are payable under the plan upon termination of employment, disability, death or retirement.

Of the $634,334$678,000 total expenses during 2011, $70,3512012, $76,214 was credited among the individual accounts of the 5 most highly compensatednamed executive officers of the Bank. Of the $634,334,Bank: Mr. Prosseda with $22,649,$24,375, Ms. Rosler with $11,019,$11,550, Mr. Miller with $13,351,$15,339, Ms. Woodland with $13,851$15,020 and MsMs. Robbins with $9,481.$9,930. Mr. Prosseda has been a member of the plan for 67 years, Ms. Rosler for 2021 years, Mr. Miller for 2627 years, Ms. Woodland for 45 years and Ms. Robbins for 2627 years.

Aggregated Options, Grants or Exercises in 20112012 Year-End Option Values

There were no grants or exercises of stock options by the named executive officer under the 1998 Stock Incentive Plan in 2011.2012.

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 20112012

The Corporation’s 1998 Stock Option Plan expired in 2008. Under the terms of the plan, options were granted for shares of the Corporation’s common stock based on the market value at the date of grant and may be exercised six months after date of grant. There are no plan provisions for reload or tax-reimbursement features. The closing price of the stock as of December 31, 20112012 was $20.50.$24.30.

| Page | 24 |

| Option Awards | ||||||||||||||||||

| Number of | Number of | Equity Incentive | ||||||||||||||||

| Securities | Securities | Plan Awards: | ||||||||||||||||

| Underlying | Underlying | Number of Securities | ||||||||||||||||

| Unrestricted | Unrestricted | Underlying | Option | |||||||||||||||

| Options | Options | Unrestricted | Exercise | Option | ||||||||||||||

| (#) | (#) | Unearned Options | Price | Expiration | ||||||||||||||

| Name | Exercisable | Unexercisable | (#) | ($) | Date | |||||||||||||

| Matthew P. Prosseda | 525 | — | — | 20.95 | 09/27/15 | |||||||||||||

| Chief Executive Officer | 750 | — | — | 16.75 | 12/27/17 | |||||||||||||

| Diane C. A. Rosler | 787 | — | — | 15.08 | 09/24/12 | |||||||||||||